A detailed description of FDA requirements for financial disclosure by clinical investigators. The content includes; 1) Five key definitions, 2) Five significant penalties for noncompliance, 3) Dollar thresholds that trigger reporting requirements.

A detailed presentation of FDA’s financial disclosure requirements and penalties including refuse to file and study rejection

Developed by

Joshua Sharlin, Ph.D.

Sharlin Consulting

Washington, D.C.

jsharlin@pipeline.com

(cell) 410-231-8900

January 2019

Joshua Sharlin’s Credentials

Dr. Sharlin’s CV is at the end of this handout.

1. Former FDA statistical reviewer and reviewer that examined safety and efficacy

2. Expert witness in lawsuits with an FDA regulatory compliance component

3. Developed over 40 presentation on FDA-related technical and regulatory topics presented to over 50,000 professionals

4. Works with firms worldwide to improve the structure and content of FDA submissions

5. Audit sponsors, Contract Research Organizations (CROs), clinical

sites, labs and software vendors for Good Clinical Practice (GCP) compliance. Identify and close compliance gaps in anticipation of an audit by FDA.

Objectives of this Presentation

Examine and understand:

1. Background and history of financial reporting requirements

2. FDA’s penalties for incomplete financial reporting

3. Key definitions

4. FDA’s view of financial reporting

5. Clinical investigator’s view of financial reporting

6. Sponsor’s view of financial reporting

Financial Reporting Requirements Exist Because of Potential Study Bias

- An FDA reviewer’s analysis and interpretation of clinical study results assumes data were collected without bias

- If bias exists it is possible study results will be unusable by FDA

| Reprint Overview: A clinical investigator’s financial interest is a potential source of bias |

| CFR reprint from 21 CFR Part 54 – Financial Disclosure by Clinical Investigators |

| Exact text from 21 CFR 54.1(b) Purpose |

| (b) The agency reviews data generated in these clinical studies to determine whether the applications are approvable under the statutory requirements. FDA may consider clinical studies inadequate and the data inadequate if, among other things, appropriate steps have not been taken in the design, conduct, reporting, and analysis of the studies to minimize bias. One potential source of bias in clinical studies is a financial interest of the clinical investigator in the outcome of the study because of the way payment is arranged (e.g., a royalty) or because the investigator has a proprietary interest in the product (e.g., a patent) or because the investigator has an equity interest in the sponsor of the covered study. |

| This section and conforming regulations require an applicant whose submission relies in part on clinical data to disclose certain financial arrangements between sponsor(s) of the covered studies and the clinical investigators and certain interests of the clinical investigators in the product under study or in the sponsor of the covered studies. FDA will use this information, in conjunction with information about the design and purpose of the study, as well as information obtained through on-site inspections, in the agency’s assessment of the reliability of the data. |

Note: Throughout this handout, the underscoring found in quotes reprinted from the CFR, guidances or other publications has been added by J. Sharlin for emphasis.

Study Bias – Definition

- Any systematic factor which could adversely affect study data

- Potential sources of study bias include:

- Financial interest of the clinical investigator (21 CFR 54.1(b))

- Randomization

- Blinding

| Reprint Overview: ICH definition of study bias |

| Reprint from FDA /ICH September 1998 guidance “E9 Statistical Principles for Clinical Trials” |

| Exact text from page 41, glossary section |

| Bias (statistical and operational): The systematic tendency of any factors associated with the design, conduct, analysis and evaluation of the results of a clinical trial to make the estimate of a treatment effect deviate from its true value. Bias introduced through deviations in conduct is referred to as operational bias. The other sources of bias listed above are referred to as statistical bias. |

Financial Reporting Requirements Apply to Marketing Applications for Drugs, Biologics & Medical Devices

- If a marketing application contains clinical data, then FDA’s financial reporting requirements by clinical investigators apply

- The applicant is responsible for submitting the required documentation

- The financial information is required whether or not the clinical investigator is under a contract

| Reprint Overview: Financial disclosure regulations state that these requirements apply to drugs, biologics and devices. |

| CFR reprint from 21 CFR Part 54 – Financial Disclosure by Clinical Investigators |

| Exact text from 21 CFR 54.3 Scope |

| The requirements in this part apply to any applicant who submits a marketing application for a human drug, biological product, or device and who submits covered clinical studies. The applicant is responsible for making the appropriate certification or disclosure statement where the applicant either contracted with one or more clinical investigators to conduct the studies or submitted studies conducted by others not under contract to the applicant |

| Reprint Overview: Additional financial disclosure regulations stating that these requirements apply to drugs, biologics and devices |

| CFR reprint from 21 CFR Part 54 – Financial Disclosure by Clinical Investigators |

| These regulations apply to drugs, biologics and medical devices |

| Exact text from 21 CFR 54.4 Certification and disclosure requirements |

| (a) The applicant (of an application submitted under sections 505, 506, 510(k), 513, or 515 of the Federal Food, Drug, and Cosmetic Act, or section 351 of the Public Health Service Act) that relies in whole or in part on clinical studies shall submit, for each clinical investigator who participated in a covered clinical study, either a certification described in paragraph (a)(1) of this section or a disclosure statement described in paragraph (a)(3) of this section. |

Financial Reporting Requirements Apply to ANDAs, 510(k)s, OTC Switching Studies & IVDs

- Almost any FDA regulated study that collects effectiveness data is subject to financial disclosure reporting requirements. This includes studies supporting:

- Generic drug applications (ANDAs)

- Labeling changes

- Switching a drug to Over the Counter (OTC)

- In vitro diagnostic submission

| Reprint Overview: FDA 2013 guidance states financial disclosure reporting applies to ANDAs and 510(k)s |

| Reprint from FDA guidance (February 2013) “Financial Disclosure by Clinical Investigators” |

| Exact text from page 25, question G.5 |

| The regulation requires an applicant whose submission relies in part on clinical data to disclose certain financial interest and arrangements. …ANDAs are subject to 21 CFR part 54 (21 CFR § 314.94(a)(13)), as are 510(k)s (21 CFR § 807.87(i)). |

| REPRINT #2. Studies supporting labeling changes must comply with financial disclosure reporting requirements |

| Reprint from FDA guidance (February 2013) “Financial Disclosure by Clinical Investigators” |

| Exact text from page 25, question G.6 |

| The regulation applies to studies submitted in a supplement when those studies meet the definition of a covered clinical study. The definition includes studies to support safety labeling changes where individual investigators make a significant contribution to the safety information. Studies to support the effectiveness of a new claimed indication are also included. (21 CFR §§ 54.2 and 54.3.) |

�

- A broad range of studies are subject to financial disclosure reporting requirements:

| Reprint Overview: Studies supporting a switch to OTC can be a covered clinical study |

| Reprint from FDA guidance (February 2013) “Financial Disclosure by Clinical Investigators” |

| Exact text from page 25, question G.7 |

| Actual use studies performed to support these applications are considered covered clinical studies if they are used to demonstrate effectiveness in the OTC setting or if they represent a safety study where any investigator makes a significant contribution (21 CFR §§ 54.2 and 54.3). Labeling comprehension studies would not be considered covered studies. |

- Under the right circumstances, studies that support a marketing application for an IVD can be subject to financial disclosure reporting requirements

| Reprint Overview: In vitro diagnostic studies can be a covered clinical study |

| Reprint from FDA guidance (February 2013) “Financial Disclosure by Clinical Investigators” |

| Exact text from page 26, question G.8 |

| Applicants who submit marketing applications for IVDs that include covered clinical studies must provide the appropriate financial certification or disclosure information (21 CFR § 54.3). |

| Under 21 CFR § 812.3(h), an “investigation” is defined as a clinical investigation or research involving one or more subjects to determine the safety or effectiveness of a device.” Thus, if an investigation of an IVD is used to support a marketing application and it meets the definition of a covered clinical study, it would be subject to this regulation (21 CFR § 54.3). |

Five Significant Penalties by FDA for Failure to Comply with Financial Reporting Requirements

- Noncompliant financial disclosure reporting can result in the following FDA actions:

- Trial is audited

- Firm is required to submit additional data analysis

- Firm is required to conduct additional studies

- Data from the biased study is rejected

- The marketing application is deemed “refuse to file” –

this can be triggered by:

- A clinical investigator without a FDA form 3454 (certification) or 3455 (disclosure)

- Missing due diligence steps used to gather financial information from clinical investigators that did not complete a Form 3454 or 3455

- Missing description of steps taken to minimize study bias

| Reprint Overview: Four FDA penalty actions for failure to comply with financial reporting requirements |

| CFR reprint from 21 CFR Part 54 – Financial Disclosure by Clinical Investigators |

| Exact text from 21 CFR 54.5 Agency evaluation of financial interests |

| (c) Agency actions to ensure reliability of data. If FDA determines that the financial interests of any clinical investigator raise a serious question about the integrity of the data, FDA will take any action it deems necessary to ensure the reliability of the data including:

(1) Initiating agency audits of the data derived from the clinical investigator in question;

(2) Requesting that the applicant submit further analyses of data, e.g., to evaluate the effect of the clinical investigator’s data on overall study outcome;

(3) Requesting that the applicant conduct additional independent studies to confirm the results of the questioned study; and

(4) Refusing to treat the covered clinical study as providing data that can be the basis for an agency action. |

- In a “refuse to file” action, FDA will:

- Return your submission

- Keep your application fee

| Reprint Overview: Regulations describing FDA “refuse to file” action for incomplete financial disclosure reporting |

| CFR reprint from 21 CFR Part 54 – Financial Disclosure by Clinical Investigators |

| These regulations apply to drugs, biologics and medical devices |

| Exact text from 21 CFR 54.4 Certification and disclosure requirements |

| (c) Refusal to file application. FDA may refuse to file any marketing application described in paragraph (a) of this section that does not contain the information required by this section or a certification by the applicant that the applicant has acted with due diligence to obtain the information but was unable to do so and stating the reason. |

| Reprint Overview: Details of FDA’s “refuse to file” action |

| Reprint from FDA guidance (February 2013) “Financial Disclosure by Clinical Investigators” |

| Exact text from page 26, question H.1 |

| FDA may refuse to file any marketing application supported by covered clinical studies that does not contain, for each clinical investigator who is not an employee of the sponsor, a certification that no financial interest or arrangement specified in 54.4(a)(3) exists, a disclosure statement identifying the specified interests or arrangements and the steps taken to minimize bias, or a certification that the applicant has acted with due diligence to obtain the required information but was unable to do so and stating the reason (21 CFR § 54.4(c)). . |

FDA Inspectors Must Examine Financial Disclosure Documentation

- The 2009 Office of Inspector General (OIG) report recommended that FDA add a review of financial disclosure information to the required activities of FDA inspectors

- The March 2011 version of the Compliance Program Guidance Manual (7348.810) was updated

- FDA inspectors must confirm:

- Existence of disclosure information for each investigator

- Information updates for one year

- That marketing applications contain FDA form 3454 or 3455 for each investigator

- Document retention meets regulations

| Reprint Overview: Instructions to FDA inspectors about how to confirm that required financial disclosure reporting has been performed |

| From Compliance Program Guidance Manual, 7348.810, “Sponsors, Contract Research Organizations and Monitors” March 11, 2011 |

| These regulations apply to drugs, biologics and medical devices |

| Exact text from page 11 |

| 1. Determine if the sponsor obtained financial disclosure information from each investigator before his/her participation in the clinical trial, as required by 21 CFR Part 54 and 21 CFR 312.53(c)(4) and 812.2(b)(5) and 812.43(c)(5).

2. Determine if the sponsor received prompt updates regarding relevant changes in financial disclosure information from investigators during the study and for one year after study completion.

3. Determine if the sponsor reported to FDA (on Form FDA 3454 and 3455, respectively), all pertinent investigator disclosures and certifications of financial information as required by 21 CFR 54.6.

4. Determine if the sponsor retained the documentation to support the certifications and disclosures of investigators’ financial information that was reported to FDA. |

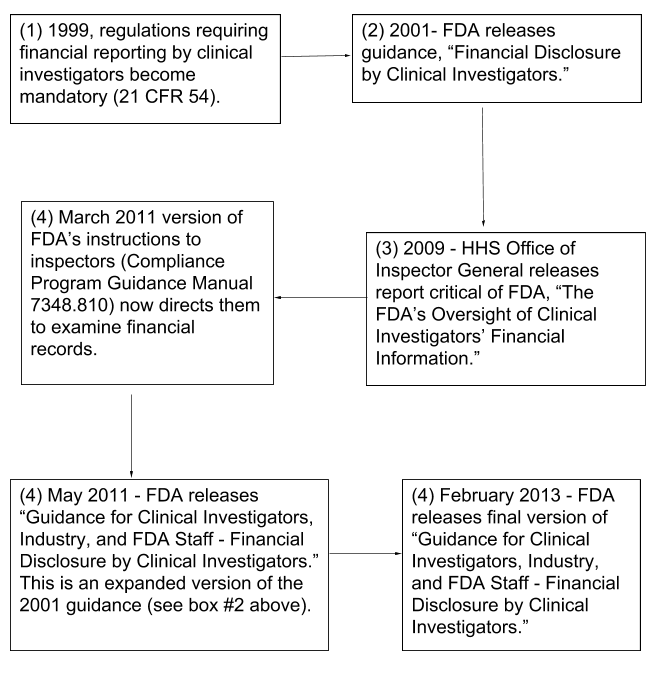

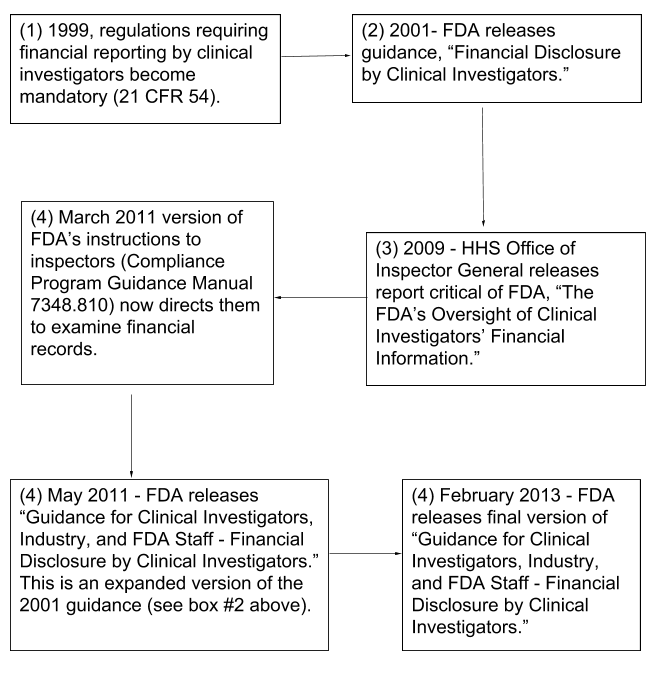

History of Financial Reporting Requirements by Clinical Investigators (flowchart)

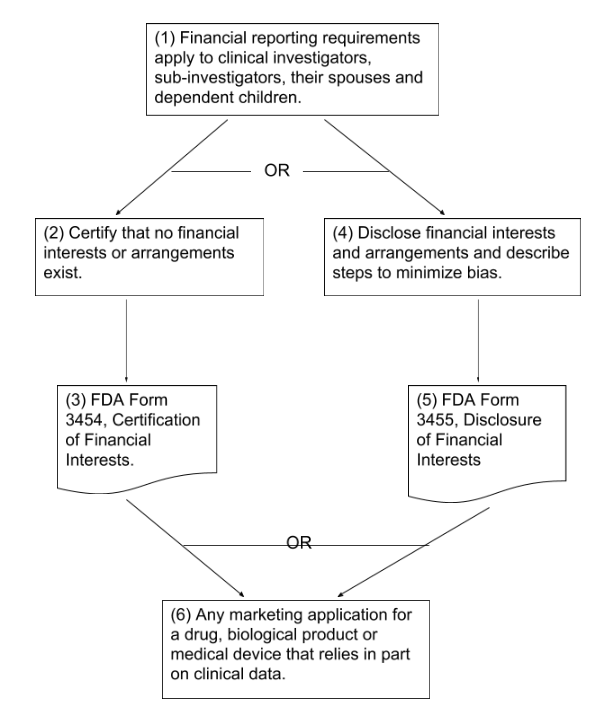

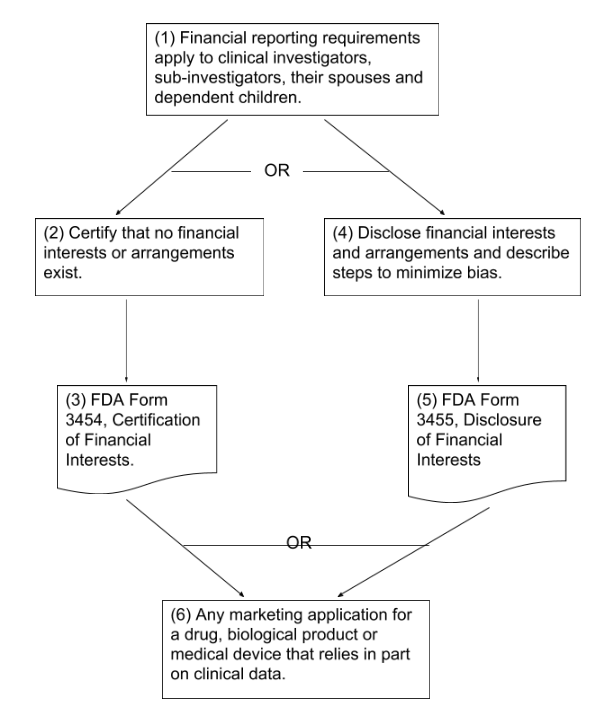

Summary of the Financial Reporting Requirements for Clinical Investigators, 21 CFR 54 (flowchart)

Overview of Responsibilities for Financial Reporting of Clinical Investigators (flowchart)

Five Key Definitions for Financial Reporting

- Compensation affected by the outcome of clinical studies

- Describes the situation where an investigator profits if a study has a favorable outcome

| DEFINITION #1 |

| CFR reprint from 21 CFR Part 54 – Financial Disclosure by Clinical Investigators |

| Exact text from 21 CFR 54.2 Definitions |

| (a) Compensation affected by the outcome of clinical studies means compensation that could be higher for a favorable outcome than for an unfavorable outcome, such as compensation that is explicitly greater for a favorable result or compensation to the investigator in the form of an equity interest in the sponsor of a covered study or in the form of compensation tied to sales of the product, such as a royalty interest. |

- Significant equity interest in the sponsor of a covered study

- For FDA, significant means $50,000

| DEFINITION #2 |

| CFR reprint from 21 CFR Part 54 – Financial Disclosure by Clinical Investigators |

| Exact text from 21 CFR 54.2 Definitions |

| (b) Significant equity interest in the sponsor of a covered study means any ownership interest, stock options, or other financial interest whose value cannot be readily determined through reference to public prices (generally, interests in a nonpublicly traded corporation), or any equity interest in a publicly traded corporation that exceeds $50,000 during the time the clinical investigator is carrying out the study and for 1 year following completion of the study. |

�Five Key Definitions for Financial Reporting (page 2)

- Proprietary interest in the tested product

- FDA casts a wide net regarding financial interests

| DEFINITION #3 |

| CFR reprint from 21 CFR Part 54 – Financial Disclosure by Clinical Investigators |

| Exact text from 21 CFR 54.2 Definitions |

| (c) Proprietary interest in the tested product means property or other financial interest in the product including, but not limited to, a patent, trademark, copyright or licensing agreement. |

- Applicant

- Applicant has a special meaning regarding financial disclosure

| DEFINITION #4 |

| CFR reprint from 21 CFR Part 54 – Financial Disclosure by Clinical Investigators |

| Exact text from 21 CFR 54.2 Definitions |

| (g) Applicant means the party who submits a marketing application to FDA for approval of a drug, device, or biologic product. The applicant is responsible for submitting the appropriate certification and disclosure statements required in this part. |

- Due diligence

- Exercising due diligence in collecting information is a critical financial disclosure activity

| DEFINITION #5 |

| Reprint from FDA guidance (February 2013) “Financial Disclosure by Clinical Investigators” |

| Exact text from page 8, question B.6 |

| “Due diligence” is a measure of activity expected from a reasonable and prudent person under a particular circumstance… |

“Covered Clinical Study” – Definition

- Covered clinical studies provide evidence of effectiveness

- Financial reporting is required for all covered clinical studies

- Before the study begins, a covered clinical study’s role in establishing a product’s effectiveness may not be known

| Reprint Overview: Official definition of “covered clinical study” from the Code of Federal Regulations (CFR) |

| CFR reprint from 21 CFR Part 54 – Financial Disclosure by Clinical Investigators |

| Exact text from 21 CFR 54.2 Definitions |

| (e)Covered clinical study means any study of a drug or device in humans submitted in a marketing application or reclassification petition subject to this part that the applicant or FDA relies on to establish that the product is effective (including studies that show equivalence to an effective product) or any study in which a single investigator makes a significant contribution to the demonstration of safety. This would, in general, not include phase l tolerance studies or pharmacokinetic studies, most clinical pharmacology studies (unless they are critical to an efficacy determination), large open safety studies conducted at multiple sites, treatment protocols, and parallel track protocols. An applicant may consult with FDA as to which clinical studies constitute “covered clinical studies” for purposes of complying with financial disclosure requirements. |

| Reprint Overview: When in doubt, it’s smart to collect financial disclosure information |

| Reprint from FDA guidance (February 2013) “Financial Disclosure by Clinical Investigators” |

| Exact text from page 23, question G.1 |

| Almost any controlled effectiveness study could, depending on outcome, become part of a marketing application, but other studies might be critical too, such as a pharmacodynamic study in a population subset or a bioequivalence study supporting a new dosage form. So for many studies, it would be prudent to collect the information for most studies in the event that the study will ultimately require certification and disclosure statements. |

�Two Types of Sponsors – Part 54 Sponsor & the IND/IDE Sponsor

- Part 54 sponsors provide material support to a study

- IND/IDE sponsor take responsibility for, and initiate, the study

- Investigator financial reporting requirements refer to the relationship between the investigator and the part 54 sponsor (there can be more than one sponsor)

| Reprint Overview: The key word is “supporting”. A part 54 sponsor “supports” a study |

| CFR reprint from 21 CFR Part 54 – Financial Disclosure by Clinical Investigators |

| Exact text from 21 CFR 54.2 Definitions |

| (h) Sponsor of the covered clinical study means the party supporting a particular study at the time it was carried out. |

| Reprint Overview: A part 54 sponsor must provide some type of material support |

| From FDA guidance (February 2013) “Financial Disclosure by Clinical Investigators” |

| Exact text from page 17, question E1 |

| FDA interprets “support” to include those who provide material support, for example, monetary support or the test product under study. |

| Reprint Overview: A clinical investigator can have a financial relationship with more than one sponsor |

| Reprint from FDA guidance (February 2013) “Financial Disclosure by Clinical Investigators” |

| Exact text from page 3 |

| A covered clinical study may have more than one sponsor for whom financial information will need to be collected. |

�Two Types of Sponsors – Part 54 Sponsor & the IND/IDE Sponsor (page 2)

- Sponsor as defined in CFR Part 54 is broader than the sponsor defined in the IND or device regulations

- Provide material support (part 54 sponsor) versus initiate

the clinical study (IND/IDE sponsor)

- There is only one IND/IDE sponsor

| Reprint Overview: An IND sponsor initiates and is responsible for the trial |

| CFR reprint from 21 CFR Part 312 – Investigational New Drug Application |

| Exact text from 21 CFR 312.3 Definitions and interpretations |

| Sponsor means a person who takes responsibility for and initiates a clinical investigation. The sponsor may be an individual or pharmaceutical company, governmental agency, academic institution, private organization, or other organization. The sponsor does not actually conduct the investigation unless the sponsor is a sponsor-investigator. A person other than an individual that uses one or more of its own employees to conduct an investigation that it has initiated is a sponsor, not a sponsor-investigator, and the employees are investigators. |

| Reprint Overview: Just like an IND sponsor, an IDE sponsor initiates and is responsible for the trial |

| CFR reprint from 21 CFR Part 812 – Investigational Device Exemptions |

| Exact text from 21 CFR 812.3 Definitions and interpretations |

| (n) Sponsor means a person who initiates, but who does not actually conduct, the investigation, that is, the investigational device is administered, dispensed, or used under the immediate direction of another individual. A person other than an individual that uses one or more of its own employees to conduct an investigation that it has initiated is a sponsor, not a sponsor-investigator, and the employees are investigators. |

�“Clinical Investigator” – Definition

- Clinical investigator as defined for financial reporting :

- Has a hands-on role in study execution and the evaluation

of patients

- Includes spouses and dependent children

- Is broader than the IND and IDE definition

| Reprint Overview: Clinical investigator definition |

| CFR reprint from 21 CFR Part 54 – Financial Disclosure by Clinical Investigators |

| Exact text from 21 CFR 54.2 Definitions |

| (d) Clinical investigator means only a listed or identified investigator or subinvestigator who is directly involved in the treatment or evaluation of research subjects. The term also includes the spouse and each dependent child of the investigator. |

| Reprint Overview: Hospital staff are usually not required to report financial data |

| Reprint from FDA guidance (February 2013) “Financial Disclosure by Clinical Investigators” |

| Exact text from page 15, question D.1 |

| It should be noted that hospital staff, including nurses, residents, fellows, and office staff who provide ancillary or intermittent care but who do not make direct and significant contribution to the data are not meant to be included under the definition of clinical investigator. |

| Reprint Overview: FDA’s definition of spouse includes same-sex spouse |

| Reprint from FDA guidance (April 2014) ‘The Meaning of “Spouse” and “Family” in FDA’s Regulations after the Supreme Court’s Ruling in United States v. Windsor—Questions and Answers: Guidance for Industry, Consumers, and FDA Staff’ |

| Exact text from page 3 |

| FDA Financial Disclosure by Clinical Investigators (21 CFR 54.2(d)). Part 54 of FDA’s regulations requires disclosure of certain types of financial interests and arrangements involving a “clinical investigator” and defines “clinical investigator” to include the investigator’s “spouse.” Consistent with the Windsor decision and HHS policy, FDA now interprets Part 54 to require disclosure of certain financial interests and arrangements involving any clinical investigator’s same-sex spouse. |

�“Clinical Investigator” Definition (page 2)

- In drug (i.e. IND) regulations, a clinical investigator is actively involved in study execution

| Reprint Overview: IND regulations have a different and more narrow definition of “investigator” than financial reporting regulations |

| CFR reprint from 21 CFR Part 312 – Investigational New Drug Application |

| Exact text from 21 CFR 312.23 Definitions and interpretations |

| Investigator means an individual who actually conducts a clinical investigation (i.e., under whose immediate direction the drug is administered or dispensed to a subject). In the event an investigation is conducted by a team of individuals, the investigator is the responsible leader of the team. ‘‘Subinvestigator’’ includes any other individual member of that team. |

- For medical device studies, the clinical investigator has a direct role in subject care:

| Reprint Overview: The definition of a medical device clinical investigator is similar to the definition used in IND regulations |

| Reprint from FDA guidance (February 2013) “Financial Disclosure by Clinical Investigators” |

| Exact text from page 13, question D.3 |

| For medical devices, investigator is defined under 21 CFR part 812 as an individual under whose immediate direction the subject is treated and the investigational device is administered, including follow-up evaluations and treatments. |

| Exact text from page 16, question D.3 |

| In general, investigators and subinvestigators sign “investigator agreements” in accordance with 21 CFR § 812.43(c), and it is these individuals whose financial interests and arrangements should be reported as they would fall under the definition at 21 CFR § 54.2(d). |

�“Completion of the Study” Definition

- Completion of the study

- Is a key definition because financial disclosure information must be promptly updated for 1 year after “completion of the study”

- In the context of financial disclosure, “completion of the study” means all subjects have been enrolled and all information about the primary efficacy variable has been collected

| Reprint Overview: . Definition of “completion of the study” as applied to financial reporting |

| Reprint from FDA guidance (February 2013) “Financial Disclosure by Clinical Investigators” |

| Exact text from page 13, question C.8 |

| For the purposes of financial reporting under part 54, completion of the study means that all study subjects have been enrolled and follow-up of primary endpoint data on all subjects has been completed in accordance with the clinical protocol. |

| Many studies have more than one phase (e.g., a study could have a short-term endpoint and a longer term follow-up phase). Completion of the study here refers to the part of the study that is being submitted in the application. |

| If there were a subsequent application based on longer term data, completion of the study would be defined using completion of follow-up for the longer term data |

| Reprint Overview: Effect of multiple sites on the definition of “completion of the study”. The study is complete when all sites are complete. |

| Reprint from FDA guidance (February 2013) “Financial Disclosure by Clinical Investigators” |

| Exact text from page 13, question C.8 |

| Where there is more than one study site, the sponsor may consider completion of the study to occur when the last study site is complete, or may consider each study site individually as it is completed. |

�“Completion of the Study” Definition (page 2)

- Be aware that FDA has more than one definition of study completion

- In this definition from the 2007 FDA legislation, rather than subject enrollment as the defining factor, final subject examination defines study completion date

| Reprint Overview: Another definition of study completion date |

| Reprint from FDA Amendment Act passed September 2007. Also called “Public Law 110-85” CFR Part 54 – Financial Disclosure by Clinical Investigators |

| Exact text from page 121, STAT 905 |

| Completion date means the date that the final subject was examined or received an intervention for the purposes of final collection of data for the primary outcome, whether the clinical trial concluded according to the pre-specified protocol or was terminated. |

�Significant Payment of Other Sorts (SPOOS) – Definition & Reportability

- A part 54 sponsor is the source of significant payments of other sorts (SPOOS)

- Examples include payments in the form of grants to do research, buy equipment, or retainers for consultation

| Reprint Overview: Official definition of SPOOS |

| CFR reprint from 21 CFR Part 54 – Financial Disclosure by Clinical Investigators |

| Exact text from 21 CFR 54.2 Definitions |

| (f) Significant payments of other sorts means payments made by the sponsor of a covered study to the investigator or the institution to support activities of the investigator that have a monetary value of more than $25,000, exclusive of the costs of conducting the clinical study or other clinical studies, (e.g., a grant to fund ongoing research, compensation in the form of equipment or retainers for ongoing consultation or honoraria) during the time the clinical investigator is carrying out the study and for 1 year following the completion of the study. |

- Reporting of SPOOS amounts should always be possible because the information can come from the part 54 sponsor making the payment

| Reprint Overview: Data about SPOOS payments should always be available |

| Reprint from FDA guidance (February 2013) “Financial Disclosure by Clinical Investigators” |

| Exact text from page 22, question F.2 |

| The sponsor should collect financial disclosure information from the clinical investigators, and, regardless of whether it collected all necessary financial information, should have information on any outcome payments (that is, payment that is dependent on the outcome of the study) and/or SPOOS made to the investigators. The applicant should request this information from the sponsor. |

�

Dollar Thresholds Which Trigger Financial Reporting

|

Dollar Thresholds Which Trigger Financial Reporting |

|

Threshold Amount (1) |

Description |

Reference |

| 1 |

$50,000 |

Any equity interest in any part 54 sponsor whose value can or cannot be publically determined |

21 CFR 54.2(b) |

| 2 |

$1 |

Any financial interest in the product including, but not limited to, a patent, trademark, copyright or licensing agreement |

21 CFR 54.2(c) |

| 3 |

$25,000 (2) |

Significant payment of other sorts (SPOOS). Payments made by the part 54 sponsor to the investigator or the institution to support activities of the investigator exclusive of the costs of conducting the clinical study, (e.g., a grant to fund ongoing research, compensation in the form of equipment or retainers for ongoing consultation or honoraria). . |

21 CFR 54.2(f) |

|

(1) The threshold amount is promptly recalculated for one year after completion of the trial (21 CFR 54.2(b) and (f)) |

|

(2) This amount is cumulative over the course of the study and for one year after study completion (See question C6 in the 2013 financial disclosure guidance.) |

| Reprint #1. Reporting thresholds apply separately to each part 54 sponsor |

| Reprint from FDA guidance (February 2013) “Financial Disclosure by Clinical Investigators” |

| Exact text from page 13, question C.7 |

| In addition, when there is more than one sponsor for financial disclosure purposes, the investigator should be apprised that the dollar amounts triggering reporting apply separately to each sponsor. |

�How to Report a Fluctuating Stock and a 401(k) Investment

- For a fluctuating stock in a part 54 sponsor, FDA expects to know when the value exceeds $50,000 and to be notified of the changing value of a stock when it’s above $50,000

- An investment in a 401(k) fund is reportable to FDA when:

- The investigator’s investment in the 401(k) exceeds $50,000 –AND

- The investigator has control over the buying and selling of stocks OR

- The 401(k) had a “substantial portion” of its capital invested in a part 54 sponsor

| Reprint Overview: How to report fluctuating stock |

| Reprint from FDA guidance (February 2013) “Financial Disclosure by Clinical Investigators” |

| Exact text from page 11, question C.2 |

| Clinical investigators should report an equity interest when the investigator becomes aware that the holding has exceeded the threshold and the investigator should use judgment in updating and reporting on fluctuations in equity interests exceeding $50,000. |

| Reprint Overview: What’s reportable in a 401(k) |

| Reprint from FDA guidance (February 2013) “Financial Disclosure by Clinical Investigators” |

| Exact text from page 11, question C.3 |

| If, however, an investigator would have control over buying or selling stocks in a mutual fund, equity interests held in such publicly traded mutual funds would be reportable. |

�Types of Financial Compensation Which Do Not Require Reporting

- Financial compensation from a part 54 sponsor that does is not reportable includes:

- Any support used in execution of the clinical trial

- Any payments to an investigator’s institution that are not specifically targeted to the investigator

- Travel expenses necessary to conduct the clinical trial

| Reprint Overview: Types of expenses which are not reportable |

| Reprint from FDA guidance (February 2013) “Financial Disclosure by Clinical Investigators” |

| Exact text from page 12, question C.4 |

| These payments do not include payments for the cost of conducting the clinical study of the product under consideration or clinical studies of other products, under a contractual arrangement, |

| If, however, the investigator were provided with computer software or money to buy software needed for use in the clinical study, that payment would not need to be reported…Finally, payments that meet the criteria for significant payments of other sorts that are made to other researchers at the institution, who are not part of the covered study, do not need to be reported. |

| Reprint Overview: Reimbursable expenses which are not reportable |

| Reprint from FDA guidance (February 2013) “Financial Disclosure by Clinical Investigators” |

| Exact text from page 13, question C.5 |

| Generally, reasonable payments made to investigators to cover reimbursable expenses such as transportation, lodgings and meals do not fall within the definition of SPOOS and, therefore, would not need to be reported. (SPOOS – significant payments of other sorts) |

�Due Diligence Requirement in Collecting Financial Reporting Information

- Applicants must exercise due diligence in their attempts to get financial disclosure information from investigators

- This is an FDA requirement

| Reprint Overview: Instance #1 of the due diligence requirement |

| CFR reprint from 21 CFR Part 54 – Financial Disclosure by Clinical Investigators |

| Due diligence is a specific requirement in the CFR |

| Exact text from 21 CFR 54.4 Certification and disclosure requirement |

| Where the applicant acts with due diligence to obtain the information required in this section but is unable to do so, the applicant shall certify that despite the applicant’s due diligence in attempting to obtain the information, the applicant was unable to obtain the information and shall include the reason. |

| Reprint Overview: Instance #2 of the due diligence requirement |

| CFR reprint from 21 CFR Part 54 – Financial Disclosure by Clinical Investigators |

| These regulations apply to drugs, biologics and medical devices |

| Exact text from 21 CFR 54.4 Certification and disclosure requirements |

| (c) Refusal to file application. FDA may refuse to file any marketing application described in paragraph (a) of this section that does not contain the information required by this section or a certification by the applicant that the applicant has acted with due diligence to obtain the information but was unable to do so and stating the reason. |

�IND/IDE Sponsors Must Collect Financial Information

from Foreign Investigators Conducting non-IND or non-IDE Studies

- Definition – The IND/IDE sponsor is the person who initiates or takes responsibility for a clinical investigation [21 CFR 312.3(b)

and 812.3(n)]

- Responsibility – The IND/IDE sponsor collects financial information before the investigator participates in the trial so any issues related

to a study bias can be addressed

- Key points:

- FDA expects to get FDA forms 3454 and 3455 from foreign studies and studies not conducted under an IND or IDE

- Financial reporting information is collected retrospectively

if needed

| Reprint Overview: Financial reporting must be done before the investigator works on the study |

| From FDA guidance (February 2013) “Financial Disclosure by Clinical Investigators” |

| Exact text from page 18, question E.3 |

| …the IND/IDE sponsor is required to collect the financial information before permitting an investigator to participate in a clinical study (21 CFR §§ 312.53, 812.20(b)(5), and 812.43).. |

| Reprint Overview: Missing financial data should be collected retrospectively from foreign studies not conducted under and IND or IDE. |

| Reprint from FDA guidance (February 2013) “Financial Disclosure by Clinical Investigators” |

| Exact text from page 20, question E.5 |

| If a sponsor did not collect this information, for example, because the sponsor conducted a foreign study that was not conducted under an IND/IDE and was not originally intended for submission to the FDA, the applicant is expected to contact the sponsor and/or clinical investigators to retrospectively obtain the financial disclosure information. |

�IND/IDE Sponsors Must Collect Financial Information

from Foreign Investigators Conducting non-IND

or non-IDE Studies (page 2)

- In conclusion, FDA has the same financial disclosure reporting requirements for all “covered studies” whether conducted in the

U.S. under an IND/IDE or conducted outside the U.S. without an IND/IDE.

| Reprint Overview: FDA expects to get forms 3454 and 3455 from device trials conducted outside the U.S. |

| Reprint from FDA guidance (February 2013) “Financial Disclosure by Clinical Investigators” |

| Exact text from page 16, question D.3 |

| For studies not conducted under an FDA-approved IDE (that is, a non-significant risk IDE or an exempt study), the sponsor would need to identify the investigators and subinvestigators they consider covered by the regulation and provide FORMS FDA 3454 and/or 3455, as appropriate. We expect that there will be at least one such person at each clinical site |

�Applicants Report Financial Information to FDA

for Both Foreign & Domestic Sites

- Applicant means the party who submits a marketing application

to FDA for approval of a drug, device, or biologic product.

(21 CFR 54.2(g))

- Applicants provide financial reporting information to FDA when the marketing application is submitted

| Reprint Overview: The responsibility of an applicant |

| Reprint from FDA guidance (February 2013) “Financial Disclosure by Clinical Investigators” |

| Exact text from page 19, question E.3 |

| IND/IDE sponsors conducting covered clinical studies outside the United States should note that the part 54 regulations do not distinguish between foreign and domestic sites. |

| Reprint Overview: The responsibility of an applicant |

| Reprint from FDA guidance (February 2013) “Financial Disclosure by Clinical Investigators” |

| Exact text from page 22, question F.3 |

| The applicant has the same financial disclosure obligations (21 CFR part 54) with respect to studies conducted at foreign and domestic sites. An applicant must include a certification or disclosure of information for each investigator participating in a foreign covered study, or, to the extent the applicant is unable to obtain sufficient information to certify or disclose, it must certify that it acted with due diligence but was unable to obtain the information and state the reason why (21 CFR § 54.4). |

�Reporting Financial Support from a Subsidiary Company & its Parent Company

- If both the parent company and its subsidiary provided material support to the study, then all investigators must report their financial arrangements

| Reprint Overview: Investigators must report their financial interest in all companies meeting the definition of part 54 sponsor |

| Reprint from FDA guidance (February 2013) “Financial Disclosure by Clinical Investigators” |

| Exact text from page 21, question E.8 |

If there are multiple companies providing material support for a covered study, the IND/IDE sponsor is responsible for collecting financial information from clinical investigators related to all companies providing that support (21 CFR

§§ 54.4, 312.53 and 812.43). |

�Record Retention & Recommended Documentation

- Financial disclosure records must be retained for two years after approval of the application

- FDA must be given access to the information

| Reprint Overview: Two year record retention requirement and FDA must have access |

| Reprint from FDA guidance (February 2013) “Financial Disclosure by Clinical Investigators” |

| Exact text from page 29, question I.1 |

| Applicants must retain certain information on clinical investigators’ financial interests and arrangements (21 CFR § 54.6(a)) and permit FDA employees to have access to and to copy them at reasonable times (21 CFR § 54.6(b)(2)). Records are to be maintained for two years after the date of approval of the application (21 CFR § 54.6(b)(1)). |

- Detailed documentation should be collected

| Reprint Overview: Documentation that should be retained includes questionnaires, correspondence and mail receipts |

| Reprint from FDA guidance (February 2013) “Financial Disclosure by Clinical Investigators” |

| Exact text from page 30, question I.2 |

| …the underlying documentation (e.g., copies of executed questionnaires returned by investigators, correspondence on the subject of financial disclosure, mail receipts, etc.) should be retained |

�Waivers from Financial Disclosure Reporting Requirements are Possible But Unlikely

- It’s theoretically possible to get an FDA waiver from financial disclosure reporting requirements (See 21 CFR §§ 312.10, 812.10, 314.90 and 814.20)

- However, the regulations require collecting this information before

a study starts and updating it on an ongoing basis

| Reprint Overview: Waivers are possible for a new drug marketing application |

| CFR reprint from 21 CFR Part 314 – Application for FDA Approval to Market a New Drug |

| Exact text from 21 CFR 314.90 – Waivers |

| (a) An applicant may ask the Food and Drug Administration to waive under this section any requirement that applies to the applicant under 314.50 through 314.81… |

| Reprint Overview: Don’t expect FDA to grant a waiver request for financial disclosure |

| Reprint from FDA guidance (February 2013) “Financial Disclosure by Clinical Investigators” |

| Exact text from page 24, question G.2 |

| The regulations allow a sponsor to seek a waiver of certain requirements, including for the financial disclosure requirements. FDA believes it is highly unlikely, however, that the granting of a waiver will be justified for studies begun after February 2, 1999, the effective date of the regulation, because the sponsor should already have begun collecting the information on an ongoing basis. |

�Summary of Key Points

- As a result of the 2009 Office of Inspector General report critical of the FDA, the agency is increasing resources used to confirm compliance with financial disclosure reporting regulations

- Financial disclosure reporting regulations apply to studies for drugs, biologics and devices that include effectiveness or important safety information,

i.e. covered studies

- FDA can impose severe penalties for non-compliance with these regulations including “refuse to file” and rejecting an entire study

- FDA has the same financial disclosure reporting requirements for all “covered studies” whether conducted in the U.S. under an IND/IDE or conducted outside the U.S. without an IND/IDE

- Significant resources are needed to meet these reporting requirements

- Obtain financial information from all investigators, their spouses and dependent children before the investigator starts work on your study

- Complete FDA form 3454 or 3455

- Document the financial arrangements

- Update this information during the study and for one year after study completion

- Document due diligence for every investigator that did not complete either FDA form 3454 or 3455

- Explain the steps taken to minimize study bias

See: Department of Health and Human Services, Office of Inspector General (OIG), “The Food and Drug Administration’s Oversight of Clinical Investigators’ Financial Information”

51 pages; January 2009.

�Next Steps

- Read the February 2013 guidance “Financial Disclosure by Clinical Investigators”

- Review the key points of financial disclosure reporting by studying the flowcharts on pages 14, 15 & 16 in this document

- History of Financial Reporting Requirements by Clinical Investigators

- Summary of the 1999 Financial Reporting Requirements

for Clinical Investigators, 21 CFR 54

- Overview of Responsibilities for Financial Reporting

of Clinical Investigators

- Create an inventory of all your “covered studies” (see page 21 in this document)

- Use the Checklist to Identify a Covered Clinical Study

- For each covered study, begin collecting the required information; be sure to consider the following checklists*

- Checklist of Investigator Names for Financial Reporting

- Checklist of Disclosable Financial Interests and Arrangements

- Checklist of Steps Taken to Minimize Potential Study Bias

- Checklist for Implementation of the Due Diligence Requirement

- Write an SOP to support this process